Choosing Between Individual and Family Floater Health Insurance: A Complete Guide

When it comes to health insurance, one of the most important decisions you’ll face is whether to opt for an individual health insurance plan or a family floater health insurance policy. Both types of coverage offer distinct advantages, depending on your needs, family size, and financial goals. In this comprehensive guide, we’ll help you understand the differences between individual and family floater health insurance, and provide insights into choosing the best health insurance plan for you and your loved ones.

What is Individual Health Insurance?

Individual Health Insurance is a policy that covers only the policyholder, providing financial protection against medical expenses like hospitalization, surgeries, and other healthcare costs. This plan is designed for people who need personalized health insurance coverage.

Key Features of Individual Health Insurance:

- Tailored Coverage: Since the policy is specifically designed for one individual, it can be customized to meet personal medical needs.

- Higher Premiums: Individual health insurance policies typically come with higher premiums, as the coverage is limited to just one person.

- No Shared Coverage: The sum insured in an individual health insurance policy is dedicated to the policyholder and cannot be shared with other family members.

- Separate Claim History: A claim made by the policyholder does not affect the coverage for others, as there is no sharing of the sum insured.

Best For:

- Single individuals or those without dependents.

- People who have specific health concerns and need tailored coverage.

- Those who prefer to have separate health coverage from other family members.

What is Family Floater Health Insurance?

A Family Floater Health Insurance Plan is a comprehensive policy that covers the entire family under a single sum insured. This type of health insurance is designed to protect the policyholder, their spouse, children, and sometimes dependent parents from medical expenses.

Key Features of Family Floater Health Insurance:

- Shared Coverage: All family members are covered under the same policy, with the sum insured shared among them.

- Lower Premiums: Typically, family floater health insurance plans offer lower premiums compared to buying individual policies for each family member.

- One Policy for Multiple Members: This plan simplifies policy management, as there is only one health insurance plan for the entire family.

- Cumulative Coverage: If one family member doesn’t use their share of the coverage, the unused sum can be utilized by another member who requires treatment.

Best For:

- Families who want cost-effective health insurance coverage.

- Families with young children, elderly parents, or a growing number of dependents.

- Families looking for a comprehensive health insurance plan that covers multiple members under one policy.

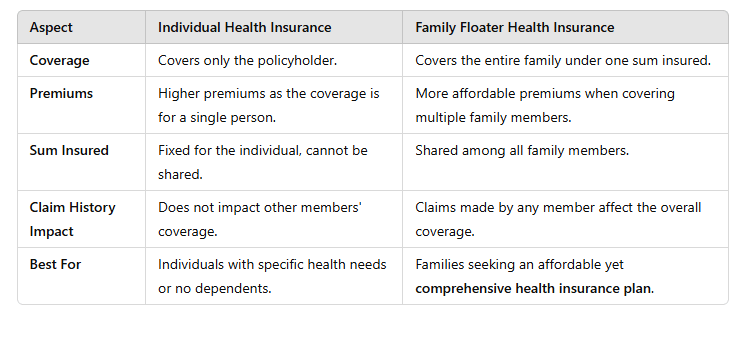

Key Differences Between Individual and Family Floater Plans

Here’s a quick comparison of the major aspects of individual health insurance and family floater health insurance plans:

Factors to Consider When Choosing Between the Two

When deciding between an individual health insurance plan and a family floater health insurance plan, there are several factors to keep in mind:

A. Family Size and Health Conditions

- If you have a large family, a family floater health insurance policy can be more cost-effective. However, if a family member has pre-existing health conditions, individual health insurance might provide more suitable coverage for them, without affecting other family members.

B. Age of Family Members

- For families with young children or elderly parents, a family floater health insurance plan can be more affordable, but it’s crucial to ensure the sum insured is sufficient to cover the medical needs of all family members.

C. Premium Budget

- A family floater health insurance plan can save money compared to buying separate policies for each member. However, it’s important to assess if the premium fits within your health insurance budget, especially as family members age or health conditions change.

D. Coverage Needs

- Individual health insurance offers more personalized coverage, especially if you have specific health concerns (e.g., chronic conditions or specialized treatments), while a family floater health insurance plan offers broader protection for the entire family.

E. Future Expansion of Family

- If you plan on expanding your family, a family floater plan is more flexible. You can easily add newborns or dependents, ensuring continuous health insurance coverage.

Pros and Cons of Individual vs. Family Floater Health Insurance

Individual Health Insurance

Pros:

- Customizable coverage based on personalized health insurance needs.

- Separate sum insured, ensuring that one member’s claims do not affect others.

- Separate claim history, which doesn’t impact other family members.

Cons:

- Higher premiums compared to family floater health insurance plans.

- Requires managing multiple policies if you want to cover your family members.

Family Floater Health Insurance

Pros:

- Cost-effective health insurance for families, as the premium is shared.

- Simplified management, with only one policy for the entire family.

- If one member doesn’t use their share of the coverage, it benefits others.

Cons:

- Shared sum insured, which could lead to insufficient coverage for one family member if another member has high medical expenses.

- A claim made by one member can reduce the overall coverage available for others.

How to Make the Right Choice for Your Family

To help you make the right decision, here are some steps to follow:

Assess Family Health Needs: Understand the medical needs of each family member. If someone has a pre-existing condition, it might be better to choose individual health insurance for them.

Check Coverage and Premiums: Compare individual health insurance plans with family floater health insurance options. Look at premiums, sum insured, and coverage details for hospitalization, surgeries, and emergencies.

Factor in Future Health Care Needs: Think about long-term health needs, such as maternity or the health concerns of aging parents, and ensure the health insurance coverage is enough to cover those.

Long-Term Affordability: Ensure the premium costs will remain affordable over time, especially as family members grow older or develop health issues.

Conclusion

Choosing between individual health insurance and family floater health insurance depends on your family’s unique needs and health goals. Individual health insurance provides more tailored coverage, while family floater health insurance offers a more affordable and convenient way to insure multiple family members under one plan. By evaluating your family’s health requirements and budget, you can choose the best health insurance plan that fits your needs.

Choose Your Personalized Health Insurance Plan with My Insurance Dost

At My Insurance Dost, we make it easier for you to choose the best health insurance plan that suits your family’s unique needs. Whether you need an individual health insurance policy or a family floater health insurance plan, our expert advisors can help you find personalized health insurance coverage that aligns with your health requirements and budget.

Why Choose My Insurance Dost?

- Expert Advice: Get tailored guidance to select the most suitable health insurance plan for you and your family.

- Wide Range of Options: Choose from a variety of individual and family floater health insurance plans from top insurers.

- Transparent Process: We simplify the process so you can make an informed decision about your health insurance coverage.

- Affordable Health Insurance: Find cost-effective coverage options that offer maximum protection.

Start Your Health Insurance Journey Today!